Summary

- Current investors looking into buying DexCom may feel discouraged and late to the party, thinking that most of the returns to be made have already materialized.

- New patients are likely to commit to a recurring stream of cash flows, boosting the company's ARR, while profitability is also set to grow amid net income margins expanding.

- While current investors are unlikely to see explosive gains, they are not that late for considerable, possibly market-beating gains in the medium term.

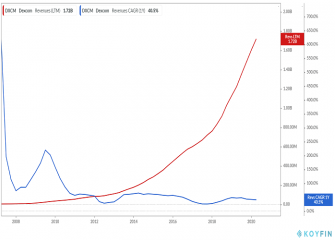

DexCom (NASDAQ:DXCM), the leading provider of continuous glucose monitoring (CGM) systems in the United States and internationally, has been a long-term compounder of shareholder returns. If one were to invest $10,000 in its shares exactly 10 years ago, today they would be worth around $289,880, indicating CAGR (compound annual growth rate) returns of ~40%. The stock's performance has continued snowballing, with shares currently trading ~152% higher compared to last year. As a result, current investors looking into buying DexCom may feel like they are too late to the party and that most of the returns to be made have already materialized. In this article, we will examine exactly that.

More specifically, in this article, we will:

- Discuss DexCom's financials and prospects,

- assess the stock's current valuation, future returns, and whether current investors are "late to the party," and

- conclude why shares remain investable despite their prolonged rally.

Financials and prospects

The conventional glucose monitoring products are inconvenient, difficult to use, and often painful, as testing is done by obtaining a sample with a single-point finger stick devices. Diabetics get their blood sample by usually pricking one of their fingertips. Through its solutions, DexCom's products provide convenience and comfort, offering diabetics access to real-time values, trend information, and timely alerts, making finger stick tests obsolete.

Because of these benefits, DexCom has been able to grow its revenues continuously. Once a customer, the continuous need for sensors allows DexCom to enjoy a recurring stream of sales. Considering that sensors have a lifetime of 10 days, and also that diabetes is a chronic disease, the company is set to enjoy a long-term stream of predictable cash flows.

As a result of such an appealing business model, since DexCom's initial FDA approval in 2006, there has not been a single LMT (last-twelve-month) period in which the company has recorded fewer revenues than its previous one. Further, despite the product being around for quite some time, the company is still managing spectacular sales growth, currently at ~40% YoY.