Summary

- Disney has suffered greatly from the pandemic, but I believe the stock remains undervalued.

- The company is redefining streaming by releasing Mulan on its platform in a PPV fashion.

- My 5-year DCF valuation yields a price target of $165, which I consider to be on the low side.

Thesis summary

The Walt Disney Corporation (NYSE:DIS) has suffered a very serious loss in revenue over the last six months. However, the long-term prospects of the company remain solid. The firm has more than met its expectations with the release of Disney+, and despite the coronavirus, people still have an appetite for the theme parks. Furthermore, the release of Mulan on Disney+ could signify the beginning of a new way of business which could bring billions in revenues.

Source: Wikipedia

Latest quarter

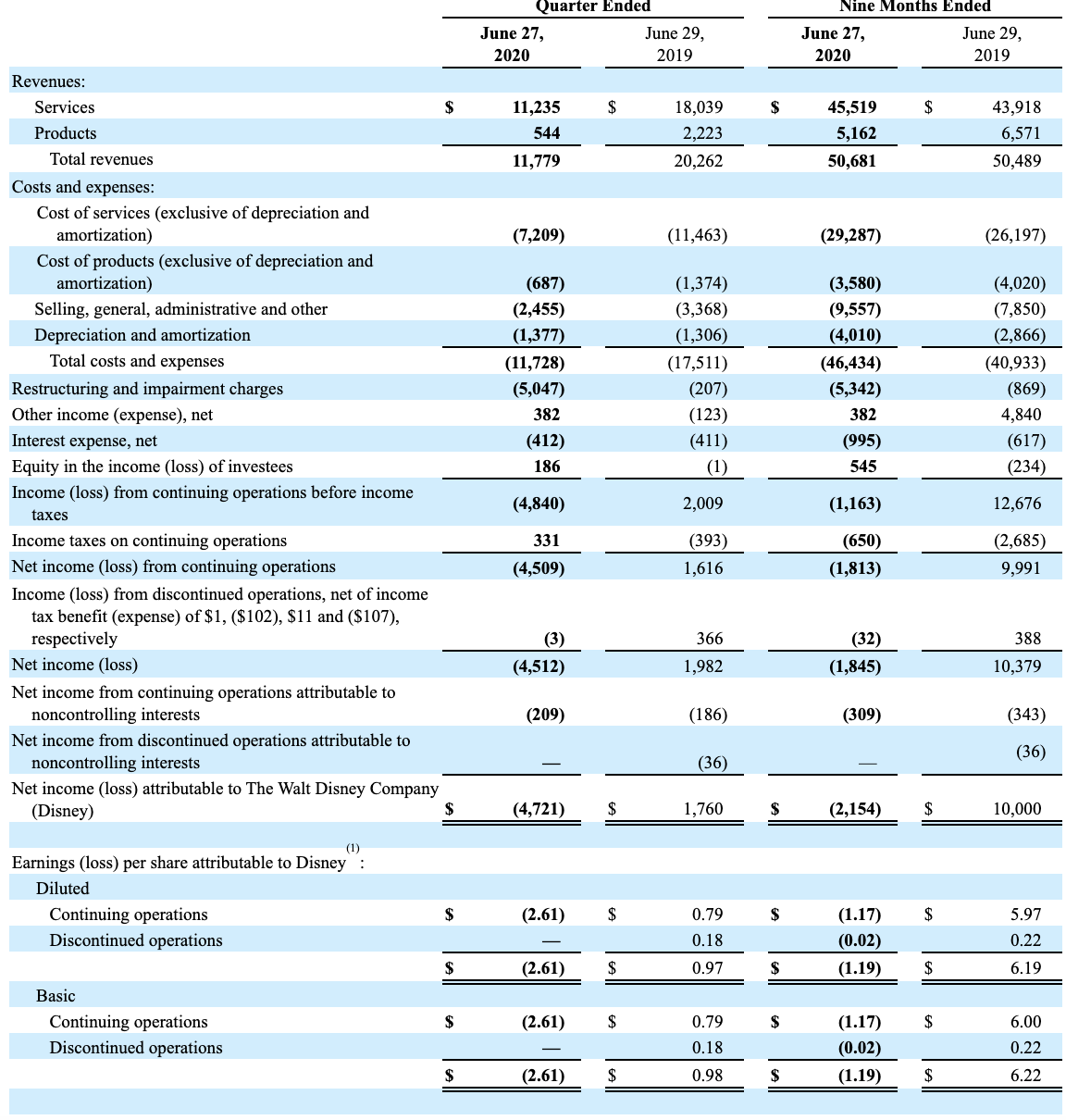

Investors have been underwhelmed by Disney's latest quarterly reports. With a drop of over 40% in revenues, it is hard to justify an investment in Disney in the short term. Below, I break down the latest available financial data.

Source: 10-Q

Over the last 3 months, Disney has produced a loss of $2.61 per share. This is a big turn from last year's $0.79 EPS, and surely something no one was expecting. While Disney has made an effort to reduce costs, these have been unable to match the fall in revenue. The nature of some of its segments, such as "Parks", prevents this. However, if we were to eliminate "Restructuring and impairment charges", the company would have turned a profit.