Summary

- The pandemic-driven demand has fueled a peak in revenue growth and margins for ResMed.

- A successful vaccine will halt the upsurge as better patient management softens the demand uptick.

- The core market remains untapped, but lack of digital focus will hold back near-term gains as virus fears drive home-based care.

- But thanks to a well-management balance sheet, the company is poised to ride out the slowdown.

- With prospects turning bleak, the trading multiple is facing a correction, highlighting further downside per the consensus estimates.

Investment Thesis

Covid-19 has fueled ventilator demand for ResMed Inc. (RMD), enabling the company to achieve a peak in revenue growth and margins. As the new therapeutics improve patient management, the sales bump will tail off. Though sleep clinics are reopening, the operations will fail to reach the pre-pandemic levels as virus fears persist. The potential of the core market remains largely intact, but the lack of digital focus in overseas markets will drag the near-term gains as the pandemic drives the home-based care.

The sales growth in July has dropped to low-single digits, and the management forecasts a U-shaped recovery while the near-normal revenue mix could pressure the margin expansion. However, thanks to robust liquidity and low gearing, the company is well-positioned to ride out the storm. The stock's premium valuation fails to justify the current outlook. To reflect the gloomy outlook, a depressed trading multiple in line with the historical averages suggests more downside for the stock to keep away the short-term focused buyers.

Source: The Company Website

Source: The Company Website

Gloomy Outlook Hurts the Share Price

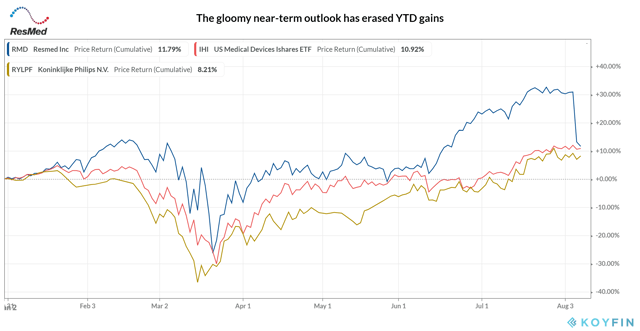

With a disproportionate impact on the momentum-driven share performance, the investor sentiment can work both ways. Following ResMed's Q4 FY20 (fourth quarter of fiscal 2020) earnings release, the company shareholders learned the lesson the hard way. The management painted a less than favorable outlook for the company pausing the years of per share dividend growth. A string of downgrades by Wall Street analysts over the past week didn't help either. Now, the bearish or neutral ratings for the company outnumber the bullish ratings by seven to three. The stock that had outperformed the IHI (iShares U.S. Medical Devices ETF), with a YTD (year-to-date) gain of ~31% until then, tanked ~15% over the following two days, more than halving the YTD gain to ~12% slightly ahead of ~11% gain in the IHI. Are the investor concerns overblown or more pain is ahead for the stock?

Source: Koyfin