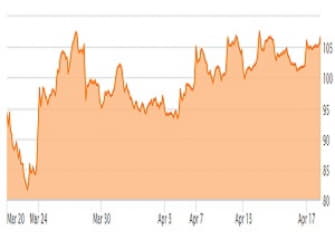

Disney (DIS) has always been a favorite stock for long-term investors. The company is well-known for its evergreen content, global brands, and a growing number of worldwide subscribers. However, along with the massive sell-off in the global stock markets, Disney’s share price has been beaten down significantly, dropping from $152 to only $106.6 per share at the time of writing. We think Disney is undervalued now.

High margin businesses and high liquidity

Disney has four main business segments, including Direct-to-Consumer & International, Studio Entertainment, and Media Networks; Parks, Experiences and Products. The majority of revenue and profits come from two main segments: Media Networks; and Parks, Experiences and Products, while the Direct-to-Consumer segment has been generating losses.

READ FULL ARTICLE HERE