Summary

- Snap has risen significantly on the back of analyst upgrades and positive news.

- However, the company’s valuation has now reached $20 billion, which is not warranted by the fundamentals.

- Bulls still think that Snap should be a buy because of its lower valuation per DAU compared to Twitter, but this is a flawed metric to value the company.

Unlike most people who are bearish on Snap Inc. (SNAP), we are not perma bears, and we are optimistic about the company's long-term future. Recently, however, it has turned more into a momentum play rather than a value/growth play and is way too expensive to be considered for a long-term investment. Having increased over 160% since January, Snap now trades at a $20 billion market cap, making it one of the largest bubbles in the market.

Upgrade after upgrade

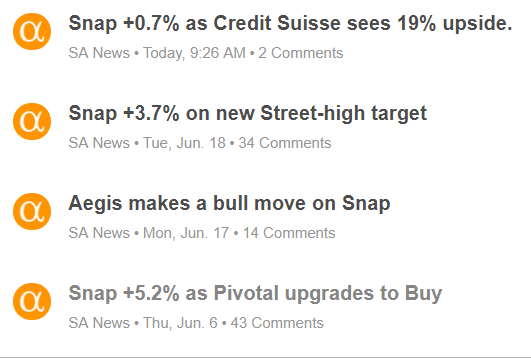

One of the main reasons Snap has risen so much is the sheer number of analyst upgrades, with 4 upgrades since June from multiple different analysts and many more before that.

(Source: Seeking Alpha)

This, combined with a great earnings report in April and with a lack of bad news, is a self-fulfilling cycle propelling Snap stock towards new highs.

Of course, there is no fundamental basis for a significant increase in the price based on analyst upgrades alone. Many studies have proven that analysts frequently get things wrong, and like the retail investor crowd, they suffer from psychological biases like herding or FOMO. However, analysts are very respected among the majority of retail and institutional investors, and therefore, their calls can significantly influence the stock price.